- Home

- Sustainability

- Governance

- Corporate Governance

Corporate Governance

● Basic Concept

In accordance with the Corporate Philosophy, the Employee Code of Conduct (Be Ethical: Reliability and sincerity, creativity and ingenuity, transparency and integrity) and the Declaration of the Group Code of Conduct, the Company is continuously strengthening corporate governance in response to the changing business environment by always concentrating on persistently pursuing compliance as people in the business world, focusing on Shareholders returns, ensuring managerial transparency and making decisions more quickly.

In accordance with these basic views mentioned above, the Company adopts a basic policy on corporate governance as stated below.

Basic Policy

1.Ensuring shareholders’ rights and equalityThe Company will take the appropriate action to effectively ensure shareholders’ voting rights at the General Meetings of Shareholders and other rights.

2.Appropriate collaboration with non-shareholding stakeholders

In accordance with the Corporate Philosophy, the Employee Code of Conduct and the Declaration of the Group Code of Conduct, the Company will aim to develop itself constantly for a long time and to continuously boost its corporate value as a company that is attractive to customers, business partners, employees, national and other public authorities, local communities and all other stakeholders that the Company regards as important.

3.Appropriate information disclosure and ensuring transparency

In addition to proper disclosure in accordance with the statute, the Company will proactively undertake information disclosure as required in the principles of the Corporate Governance Code for the purposes of ensuring the transparency and fairness of the Company’s decision-making and of achieving effective corporate governance.

4.Duties of the Board of Directors and other bodies

The Board of Directors has the duties of determining the basic management policy and supervising the management. It also makes decisions on business execution of great quantitative and qualitative significance in addition to prerogatives as specified in laws and ordinances. Meanwhile, in view of the importance of prompt decision-making, the authority to make decisions on ordinary business execution is increasingly delegated to Directors and Executive Officers, and the board will supervise their execution status. As personnel elected by shareholders to undertake business management, Directors have the obligation of loyalty and diligence in fulfilling their duties to contribute to the Company’s continuous growth and to medium- and long-term increases in corporate value.

5.Dialogues with shareholders

● Status of Compliance with the Corporate Governance Code

ITOCHU ENEX implements all the principles of the Code.See "Corporate Governance Report"

● Corporate Governance System

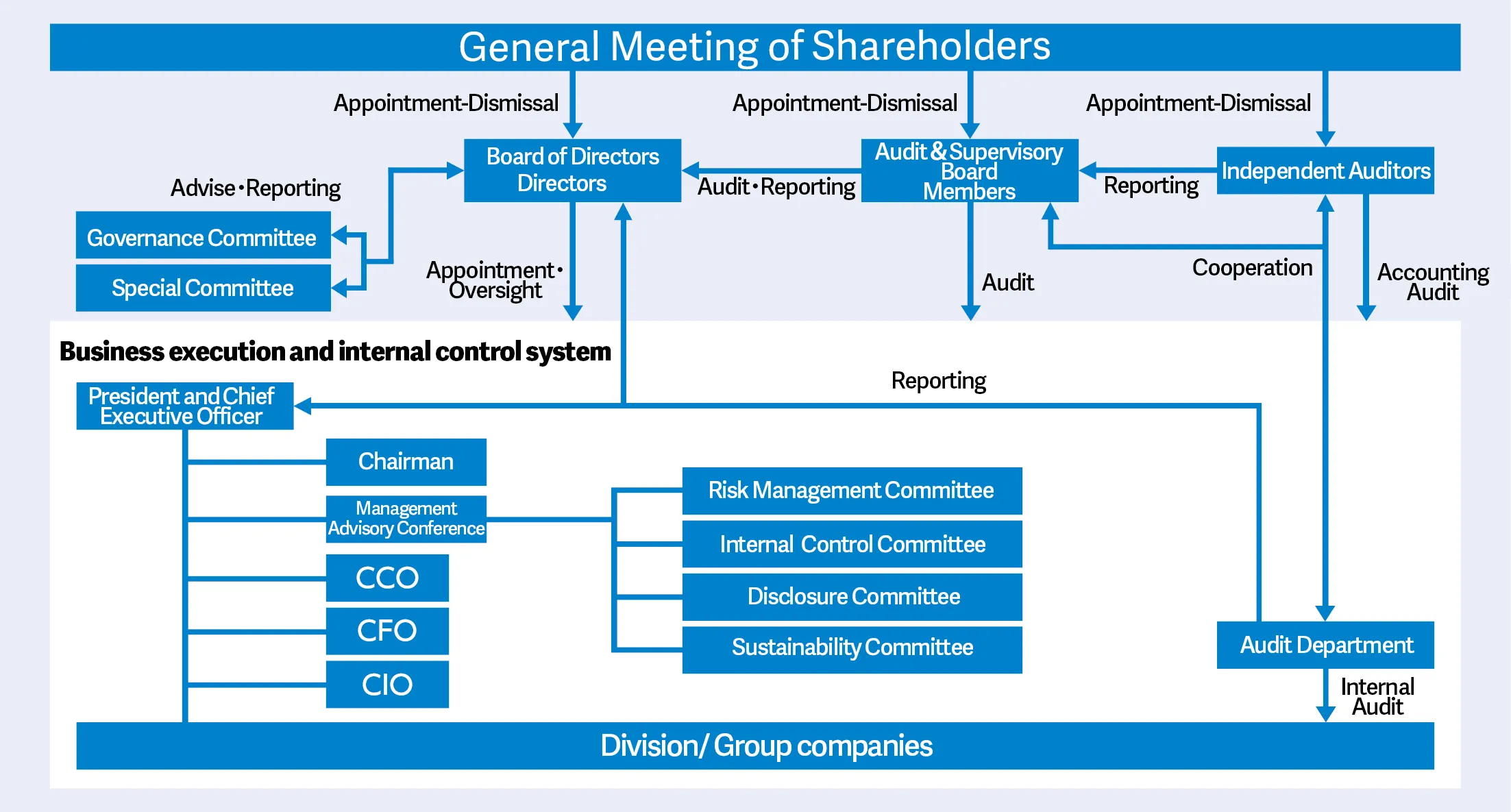

ITOCHU ENEX has a Board of Directors and an Audit & Supervisory Board. (As of June 18, 2025)

・ Business execution, internal control, managerial monitoring, risk management system, etc. (Corporate governance system chart)

1.Board of Directors

- The Board of Directors consists of a total of 8 members (1 female Director, and the ratio of Outside Directors 50.0%), 4 of whom are Internal Directors and 4 of whom are Outside Directors. In accordance with laws and ordinances and the Company’s Articles of Incorporation, regulations for Directors and other internal rules, the board makes decisions on important matters and oversight the Directors’ business execution.

- In FY2024, a total of 11 meetings of the Board of Directors were held. All Directors and Audit & Supervisory Board Members participated in all of these meetings. Major matters discussed included the medium-term business plan, investment projects of high importance, internal control, corporate governance, and sustainability practices.

- The Directors execute the duties assigned to them in accordance with the roles determined by the Board of Directors and with laws, ordinances, the Articles of Incorporation and internal rules.

■ Policies and Procedures in the Nomination of Director Candidates

To allow its Board of Directors to perform appropriate oversight of management and make decisions on important business execution, the Company appoints, in principle, the President, Chief Financial Officer (CFO), Chief Compliance Officer (CCO), and designates candidates for Directors and Executive Directors from managers with the highest responsibility for their divisions. The Company also designates several candidates for Outside Directors to make the ratio of Outside Directors one third or more with the goal of strengthening the Board of Directors’ oversight of management. The Company designates candidates for Outside Directors from individuals who are expected to contribute to its management using their extensive knowledge acquired through experience in their fields. The Company appoints those expected to contribute to its management using their extensive knowledge cultivated through experience in their respective fields as Outside Directors.

Based on this policy, the President drafts a proposal on Director candidates. After deliberation and examination by the Governance Committee, the Board makes a decision regarding submission of an appointment proposal to a General Meeting of Shareholders. In addition, if a person proves to lack the required quality or ability needed to execute the job as a Director, after deliberation and examination by the Governance Committee, the Board of Directors makes a decision regarding submission of a dismissal proposal to a General Meeting of Shareholders.

■ Director Remuneration

Directors' remuneration is structured differently depending on whether Directors are executive or non-executive.

The remuneration for Executive Directors is composed of base remuneration, which is fixed remuneration, and bonuses and stock remuneration, which are performance-linked remuneration.

Remuneration for Non-Executive Directors comprises only base remuneration, with no bonuses or stock remuneration provided, from the perspective of their roles and independence.

■ Remuneration Plans for Directors

The Governance Committee has been consulted about the policy on determining remuneration for each individual Director. On receiving the response from the Committee, the Board of Directors passed a resolution on that policy at a meeting held on February 25, 2021. It also adopted a resolution to partly revise the composition percentage of remuneration at its meeting on April 28, 2023.

1. Basic policy

Remuneration for Directors of the Company is designed to attract talented human resources with the ability to implement the Company's Corporate Philosophy and to motivate them to contribute to the sustained improvement of its corporate value. It is the Company's basic policy to determine remuneration paid to each Director at an appropriate level based on his/her position and duties.

2. Remuneration system for Directors

-Remuneration for Executive Directors comprises fixed basic remuneration (monthly remuneration) and performance-linked remuneration that fluctuates according to performance.

-Remuneration for Non-Executive Directors comprises only fixed basic remuneration (monthly remuneration) from the perspective of their roles and independence.

3.Policy, etc. for determining the remuneration of individuals

- To flexibly determine the amount of remuneration for individuals, Nobuyuki Tabata, the Representative Director President of the Company, is delegated to determine specifics based on standards established in advance.

- Changes made to the above composition of remuneration, basic remuneration, and bonuses require approval by the Board of Directors after consultation with the Governance Committee. Changes in the stock remuneration require approval by the Board of Directors or at a General Meeting of Shareholders, after consultation with the Governance Committee.

- The Company has established a system in which the Governance Committee receives one or more reports a year on the overall distribution of remuneration for individual Directors, ensures that such activities are conducted appropriately in line with this policy, and guarantees their objectivity, fairness, and transparency.

In addition, the Board of Directors receives the results of deliberations and examinations, and reports on the appropriate remuneration of individual Directors in line with this policy from the Governance Committee, and the Company believes that the activities of the Board of Directors are also in line with this policy.

■ Evaluation as to the effectiveness of the Board of Directors

The Company asked all Directors and Audit & Supervisory Board Members to give their opinions based on their own evaluation of the effectiveness of the Board of Directors as a whole in FY2024, including the composition, operation status and support structure of the board. By referring to these opinions as well as evaluation and analysis by third-party evaluation organizations and after deliberation and examination by the Governance Committee, the Board of Directors conducted the analysis and evaluation regarding the effectiveness of the Board of Directors.

The evaluation of FY2024, as in the previous fiscal year, indicated that the Company has generally maintained a high level in each evaluation item, and that the operation of the Board of Directors of the Company was appropriate overall, securing its effectiveness. On the other hand, opinions and advice were provided to enhance discussions. The Company will draw on these evaluation results to seek to further improve the supervisory and decision-making functions of the Board of Directors.

2.Executive Officer System

For strengthening the Board of Directors' decision-making function and oversight function and for increasing efficiency in business execution, the Company adopts the Executive Officer system. Following decisions made by the board, Executive Officers perform their respective duties as delegated by the board and the Representative Director. The Company had a total of 10 Executive Officers, including those additionally serving as Directors.

3.Special Committee, Governance Committee

- For the purposes of strengthening the Board of Directors’ oversight function and increasing the transparency of the decision-making process, the Company has established a Special Committee, a voluntary, standing consultative body of the Board of Directors. This committee consists of independent individuals, including Independent Outside Directors. Additionally, the Company has a Governance Committee, which is also a standing committee. The majority of its members are Independent Outside Directors. The functions and composition of each committee are as follows.

- Special Committee

(Functions) Deliberation and examination of material transactions or actions involving conflicts of interest with a controlling shareholder or a minority shareholder

(Composition) A total of 6 members: 6 Independent Directors/Auditors (4 Outside Directors, 2 Outside Audit & Supervisory Board Members)

- In FY2024, the Special Committee met 4 times and confirmed the status of transactions and activities with the controlling shareholder, with the attendance of all the Committee Members.

- Governance Committee

[Functions] Deliberation and examination of the nomination and remuneration of Directors, material transactions or actions with a related party (excluding a controlling shareholder) and other matters relating to corporate governance.

[Composition] A total of 7 members: 6 Independent Directors (4 Outside Directors and 2 Outside Audit & Supervisory Board Members), and 1 Internal Director

- In FY2024, the Governance Committee met 11 times to deliberate on and examine matters such as the nomination and remuneration of Directors and the assessment of the effectiveness of the Board of Directors, with the attendance of all the Committee Members.

4.Management Advisory Conference and various committees

The Company has established the Management Advisory Conference and several committees: the Risk Management Committee, the Internal Control Committee and the Disclosure Committee and the Sustainability Committee. They are aimed at helping the President and the Board of Directors to make appropriate and swift decisions on business execution. As an advisory body for the President, the Management Advisory Conference discusses significant matters related to the Company’s overall management policy and its business administration.

Different internal committees carry out careful inspections and deliberations on managerial issues in their respective domains. These activities are helpful to the President and the Board of Directors in terms of decision-making. The principal internal committees and their roles are as follows:

- Risk Management Committee: Deliberation and consideration matters in connection with risk management, such as the identification and analysis of risks that could have a material impact on the management, measures against such risks, the prevention of their occurrence and actualization, and the announcement thereof.

- Internal Control Committee: Deliberations on matters in connection with the construction and operation of the internal control system.

- Disclosure Committee: Comprehensive and prompt collection of important information within the Group and deliberation of whether to disclose information and of the accuracy, clarity, sufficiency, fairness and positivity of the information

- Sustainability Committee: Deliberations on and monitoring of sustainability policy, issues, measures, etc. from a long-term perspective and implementation and direction of the sustainability management strategies across the entire Group.

5.Audit & Supervisory Board Member, Audit & Supervisory Board

- The Audit & Supervisory Board consists of four members, including two standing auditor and two part-time auditors (including two outside auditors). In addition, three employees who assist Audit & Supervisory Board Members (who also serve in the Audit Department) have been assigned to support the execution of duties by Audit & Supervisory Board Members.

- In FY2024, the Audit & Supervisory Board met 14 times to hold the following discussions and make the following resolutions and reports, with the attendance of all the Audit & Supervisory Board Members.

[Eleven resolutions] Audit & Supervisory Board Member audit report, Audit & Supervisory Board Member audit plan, reappointment of Accounting Auditor, consent to remuneration for accounting auditor, consent to the election of Audit & Supervisory Board Member candidates and a substitute Audit & Supervisory Board Member candidate, etc.

[Three discussions] Remuneration for Audit & Supervisory Board Members and concurrent positions of Outside Audit & Supervisory Board Members as officers of other companies.

[Twenty three reports] Monthly reports by full-time Audit & Supervisory Board Members, audit results by Accounting Auditors, audit plans by Accounting Auditors, etc.

- In addition to the above, the Audit & Supervisory Board also shares and discusses compliance issues and other issues identified through audit activities.

- With regard to audit plans, we have established priority audit items for each year. In FY2024, the Audit & Supervisory Board engaged in auditing activities with the following items as priority audit items, and exchanged opinions with executive management as necessary.

① Appropriateness of the decision-making process of the Board of Directors and the rationality of its decisions, etc.

(Audit perspective)

- Sufficient information disclosure and discussions based on appropriate risk analysis and assessments

- The lawfulness and economic rationality of decisions that have been made

- Discussions of medium- and long-term management strategies and issues

② State of execution of duties by Directors

(Audit perspective)

- Legality and appropriateness of the execution of duties through direct dialogues

- Appropriateness of decision-making procedures

- Follow-up actions and monitoring after decision making

- Governance of subsidiaries and equivalents (support and supervision)

- Proactive and conservative governance of subsidiaries and equivalents and offering of information to outside officers

③ Preparation for the implementation of next-generation core systems and adoption of the revised J-SOX

(Audit Perspective)

- Status of IT risk assessment and risk countermeasures

- Assessment of the effectiveness of next-generation core systems before the commencement of their operation and operation after they go live

- Adoption of the revised J-SOX in internal control activities

- Individual Audit & Supervisory Board Members conduct activities in accordance with the Audit & Supervisory Board Member auditing standards, the audit policy, and the allocation of duties determined by the Audit & Supervisory Board while also using means such as remote conferencing.

① Interviews with Directors and Executive Officers: Audit & Supervisory Board Members meet with Representative Director and President seven times a year and with other Directors and Executive Officers every six months to confirm the state of execution of duties and provide feedback on audit findings.

② Interviews with General Manager of business divisions: Audit & Supervisory Board Members conduct interviews with the General Managers of business division planning & administration departments and administration departments every six months.

③ Attendance at important meetings: In addition to the Audit & Supervisory Board, Audit & Supervisory Board Members attend meetings of the Board of Directors, the Management Advisory Conference, and Advisory Board (Special Committee, Governance Committee, Risk Management Committee, Internal Control Committee, Disclosure Committee, and Sustainability Committee), and other major internal meetings to express necessary opinions.

④ Monitoring of business matters: Full-time Audit & Supervisory Board Members attend project review meetings to review important matters submitted to the Board of Directors and Management Advisory Conference, and view all application documents for matters that Directors and Executive Officers can approve in accordance with job authority regulations.

⑤ On-site inspections: Full-time Audit & Supervisory Board Members actively conduct on-site inspections of major business sites and Group companies to understand local conditions. When selecting locations for on-site inspections, decisions are made based on risks, such as the state of compliance and small-scale and remote business sites.

⑥ Three-way audits: Full-time Audit & Supervisory Board Members receive monthly reports from the Internal Audit Section. They also attend audit meetings and share information through close cooperation to understand the Group's situation. They hold 14 meetings with the Accounting Auditor annually to explain the results of audits and audit plans and to discuss quarterly review reports, key audit matters (KAMs) and other matters to strengthen cooperation.

⑦ Strengthening Group governance: In addition to dialogues with the management teams at Group companies, full-time Audit & Supervisory Board Members aimed to collect and share information by participating in Group Company Audit & Supervisory Board Member liaison meetings and participating in ITOCHU Group Audit & Supervisory Board Member liaison meetings. Audit & Supervisory Board Members will continue working to strengthen Group governance.

⑧ Strengthening cooperation with Outside Directors: The Audit & Supervisory Board held four round-table meetings to promote communication and strengthen collaboration with Outside Directors.

■ Policy and Procedures for Nomination of Audit & Supervisory Board Member Candidates

To ensure that its Audit & Supervisory Board Members properly perform auditing and the audit of management, the Company appoints those with knowledge of the Company’s management and with advanced expert knowledge and extensive experience in accounting, financial and legal affairs, risk management and other domains as Audit & Supervisory Board Members candidates. It appoints as Outside Audit & Supervisory Board Members those expected to properly audit and oversee its management with the use of their advanced specialist knowledge and extensive experience in different areas. With regard to the policy mentioned above, the President drafts a proposal on the Audit & Supervisory Board Member candidates after discussing with the Standing Audit & Supervisory Board Members, and the Board of Directors makes a decision regarding submission of an appointment proposal to a General Meeting of Shareholders upon the approval of the Audit & Supervisory Board.

■ Remuneration for Audit & Supervisory Board Members

The remuneration for Audit & Supervisory Board Members is determined through consultation among Audit & Supervisory Board Members and comprises only base remuneration, with no bonuses or stock remuneration provided.

【Skills Matrix of Directors and Audit & Supervisory Board Members】

| Management in General | Corporate | Sales | Priority Areas for Realizing the Mediumterm Business Plan | Others | |||||

| Finance and Accounting Risk Management | Legal Affairs and Internal Control Compliance | Sales and Marketing | SDGs Sustainability | HR and Labor HR Development | Business Investment | Internationality | |||

| Director | Nobuyuki Tabata | ◎ | |||||||

| Kunio Nishimura | ○ | ○ | ○ | ||||||

| Satoshi Watanabei | ○ | ○ | ○ | ||||||

| Tetsuya Yamada | ○ | ○ | ○ | ||||||

| Outside Director | Ichiro Saeki | ○ | ○ | ○ | |||||

| Takuya Morikawa | ○ | ○ | ○ | ||||||

| Chie Sato | ○ | ○ | ○ | ||||||

| Shozo Tokuda | ○ | ○ | ○ | ||||||

| Audit & Supervisory Board Member | Ryohei Suda | ○ | ○ | ○ | |||||

| Yasuhiro Imazawa | ○ | ○ | ○ | ||||||

| Outside Audit & Supervisory Board Member | Masako Iwamoto | ○ | ○ | ○ | |||||

| Sonoko Kajiyama | ○ | ○ | ○ | ||||||

* Our approach to presenting skills and areas of expertise is as follows. The table above shows the skills and areas of expertise that are particularly expected of each Director and Audit & Supervisory Board Member, that it does not represent all their skills and areas of expertise.

- The “◎” is limited to “Management in General” and indicates officers, including those with experience, serving as Representative Director of the Company who are responsible for overall management.

- The “○” indicates the areas in which each particular Director or Audit & Supervisory Board Member can be expected to provide valuable advice for or supervision of the executive department.

● Criteria for Determining the Independence of Outside Directors

With regard to Outside Directors and Outside Audit & Supervisory Board Members, the Company nominates those with knowledge in specialized areas such as business administration, law and accounting. The Company aspires to have them involved in the supervision of its management and business execution from different perspectives so that it will result in the enhancement of the Company’s corporate value.

In regard to criteria for determining the independence of Outside Directors, the Company determines such independence after confirming the absence of conditions (1) through (6) below in accordance with the Companies Act and the requirements for independence set forth by the Tokyo Stock Exchange, Inc. and other financial exchanges in Japan.

(1) Is currently, or has ever been within the past 10 years, an Executive* of the Company or of a subsidiary of the Company (for Outside Audit & Supervisory Board Members, this includes Directors who are not Executives). However, for those who were Directors or Audit & Supervisory Board Members who did not execute business operations, the fact that they were Executives of the Company or its subsidiaries during the 10 years prior to assuming office shall be included.

(2) Is currently, or has been within the past 10 years, an Executive or Non-executive Director (including Audit & Supervisory Board member for Outside Audit & Supervisory Board member) of the parent company of the Company or an Executive of another company owned by the Company’s parent company.

(3) Is currently, or has been within the past year, a major shareholder owning a stake of 10% or more, either directly or indirectly, of the Company’s shares, or an Executive of such shareholder.

(4) In the most recent financial reporting period, has been a major customer or an Executive of a major customer that accounted for more than 2% of the total transaction volume (sales or purchases) with the Company.

(5) Within the past year, has served as a consultant, accounting specialist, legal profession, or tax practitioner receiving annual compensation of 10 million yen or more from the Company in addition to Director’s compensation (if the person receiving such compensation is an organization, such as a corporation or association, a person who belongs to such organization).

(6) A person who was a spouse or a relative within the second degree of kinship of a person stated in either of the following (a) or (b) (excluding immaterial persons)

(a) Currently or in the past year, a person who is an Executive of the Company or a subsidiary of the Company (including a Director who does not execute business for an Outside Audit & Supervisory Board member). However, this includes Directors who are not Executives of the Company.

(b) Any person who falls under (2) through (5) above.

* “Executive” refers to Directors, Executive Officers, and other such employees.

● Policy on cross-shareholdings

The Company has a policy of holding shares of any customer or business partner solely on the condition that holding such shares is deemed to have commercial potential in the future and is strategic. The policy is limited to holdings in which the chances of achieving an investment return are high and the holdings contribute to increasing the Company’s corporate value.

With regard to such shares we already hold, the Board of Directors examines the reasonability of the holding of individual shares every year and the continuation or reduction of cross-shareholdings will be properly determined from the perspective of the chances of achieving the expected investment purpose or whether or not they are creating economic added-value that may lead to enhancing the Company’s corporate value.

Examination results as of the Board of Directors held on May 16, 2025 are as follows:

The Company specifically examined the cross-holding shares the Company holds (all 6 issues), to determine whether or not the purpose of the crossholding is appropriate on an individual issue basis, and whether or not benefits or risks associated with the cross-shareholdings are commensurate with the Company’s capital cost. As a result, the examination has confirmed that the current cross-shareholdings are appropriate.

〈Standard for exercising voting rights as to cross-shareholdings〉

In exercising voting rights concerning the cross-shareholdings, the Company makes it a rule not to abstain from voting, so as not to give another party carte blanche in principle. Moreover, the Company makes a decision for and against each proposal tabled after examining individual proposals, not using uniform standards such as short-term operating results/share prices, but taking the perspective of whether or not it will help increase the medium- or long-term corporate value of the Company and the companies in which shares are held, in view of non-financial information such as the business policies, strategies and suchlike of the company in which shares are held.